In 1924, our founder James B. Duke made an initial gift of $40 million. A bequest of $67 million was added to the Trust after his death in 1925. Since then, the assets of The Duke Endowment have achieved significant growth, from $107 million to $5.02 billion. Since the Endowment’s inception, approximately $5.1 billion has been distributed in grants.

Financials

The Board of Trustees, through its Committee on Investments and investment staff, oversee, review and implement investment policies and guidelines. They are guided by two objectives: to support program initiatives and beneficiaries and to preserve the value of The Duke Endowment portfolio.

Total Net Assets

(in $ billions)

2024 Investments

Since July 2007, The Duke Endowment’s investment portfolio has been managed by DUMAC Inc., a professionally staffed investment organization in Durham, N.C., governed by Duke University. Please see the DUMAC website for additional information.

During 2024, the investment return on the Endowment’s portfolio was 7.0 percent.* Investment gains across public and private asset classes were somewhat offset by losses in private real estate and portfolio hedges. The Endowment’s investment portfolio increased in value from $4.88 billion to $4.96 billion from December 31, 2023, to December 31, 2024, impacted by investment returns, grants and expenses. The Endowment’s total assets were $5.02 billion at year end.

For the 10-year period ending December 31, 2024, the Endowment’s investment portfolio returned 9.0 percent annualized, net of fees, outperforming its policy benchmark, which returned 6.8 percent annualized, and a 70 percent MSCI All Country World Index/30 percent Bloomberg U.S. Aggregate Bond Index benchmark, which returned 7.0 percent annualized over the same period.

*Investment return is based on pre-audit investment valuations.

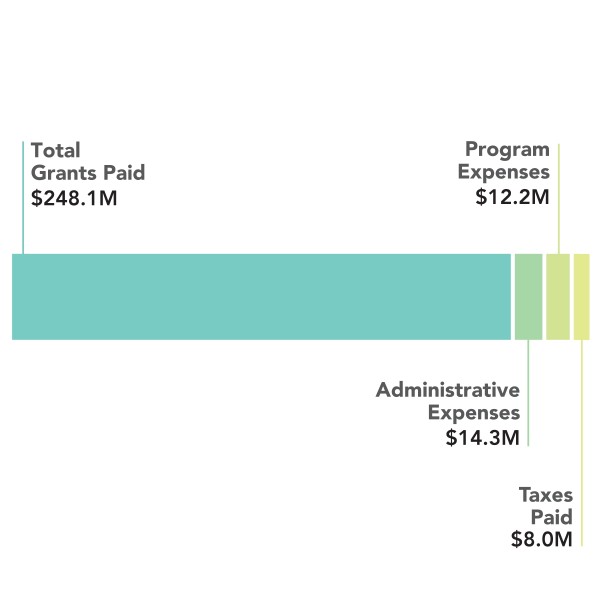

2024 Grants & Expenses

Since James B. Duke’s death in 1925, approximately $5.1 billion has been distributed in grants.

More than 85 percent of the Endowment’s total spending goes directly to grantmaking, which compares favorably to foundations of similar size. This chart and the legend below show our grantmaking in the context of other spending.